Simply hunt for Rhame & Gorrell on either System to download totally free or click the one-way links underneath.

These trusts, upon the proprietor’s death, obtain the remaining price of retirement accounts and function a bulwark against likely losses to creditors, divorces, and also other lawful claims, making certain the owner’s supposed distribution of wealth remains intact.

On a regular basis reviewing and updating beneficiary designations is crucial, especially immediately after main lifetime occasions for example relationship, divorce, or the beginning of a child. Lots of people fail to remember to update their beneficiaries, which can result in assets unintentionally about to an ex-spouse or maybe a deceased relative.

Deciding on the Right Beneficiary Deciding on the proper beneficiaries for your personal retirement accounts is additionally essential when guarding your assets to make certain are handed on As outlined by your wishes.

Liability insurance plan is significant since it provides protection for third-party claims, for example damages induced resulting from damage or assets damage, for which the insured is held legally responsible.

From shielding against creditors to ensuring security within the wake of employer economic struggles, ERISA-covered options offer a important Basis for secure retirement savings.

Since LLCs and LPs are different legal entities and assets within just them aren’t considered “owned” by someone, They're thought to be held during the LLC or LP. A plaintiff who wants to access the assets of somebody will have to sue the LLC or LP instead of the owner.

Fluctuations in standard marketplaces can result in devastating losses without the adequate diversification of one's retirement portfolio.

A significant part of someone’s Web worthy of is tied to assets that aren't retirement-linked, for example an investment account, a residence, or even a stake in a firm. To safeguard these assets, a proactive strategy is often desired. This could be created effectively in advance of any problems arise.

This breach from the usually impenetrable defend underlines the necessity of arduous monetary planning and prudent tax our website management to minimize the chance of opportunity claims by federal entities.

Among the official statement list of most vital advantages of appropriate beneficiary designation is the fact it permits retirement assets to bypass probate. Probate is usually a lengthy and often highly-priced legal procedure which will hold off the distribution of funds and expose assets to creditors.

Leaving your wealth in hard cash savings about an extended interval could place it in danger from inflation, which might erode its benefit eventually. Handling hazard

This isolation gets rid of the chance of creditors accessing the funds and allows for nicely-informed, goal determination-producing in the most effective interest of system individuals.

Account Checking with 3rd-Occasion Alerts: You will find services that allow trusted third parties to receive alerts each time a transaction appears suspicious. This allows you to appoint a trustworthy personal that can help watch your accounts and detect any fraudulent routines. Find out Additional Techniques Annuities to Protect Your Earnings An annuity is yet another way to guard your retirement money from investment losses as a consequence of current market volatility or investment errors. An annuity can provide a stream of month-to-month retirement revenue that lasts the rest of your daily life. With most annuities your assets are backed by a few of the biggest insurance policy firms on the planet, separate with the stock sector, which guards you from particular market place losses.

Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Amanda Bearse Then & Now!

Amanda Bearse Then & Now! Mike Vitar Then & Now!

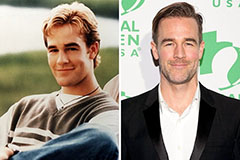

Mike Vitar Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now!